How Long Does It Take to Get Tax Refund

Filing taxes is often a stressful time for many individuals and businesses. However, one of the bright spots of tax season is the anticipation of receiving your tax refund. The timeline for receiving this refund varies based on several factors, including the method of filing, payment preferences, and processing requirements. This guide will provide a complete breakdown of the tax refund process, timelines, and tips to ensure you get your refund as quickly as possible.

Table of Contents

1. Understanding Tax Refunds

A tax refund is issued by the government when a taxpayer has overpaid taxes during the year. This can happen due to excessive withholding from your paycheck, refundable tax credits (such as the Earned Income Tax Credit), or other financial adjustments. Essentially, it is the government paying back what is owed to you.

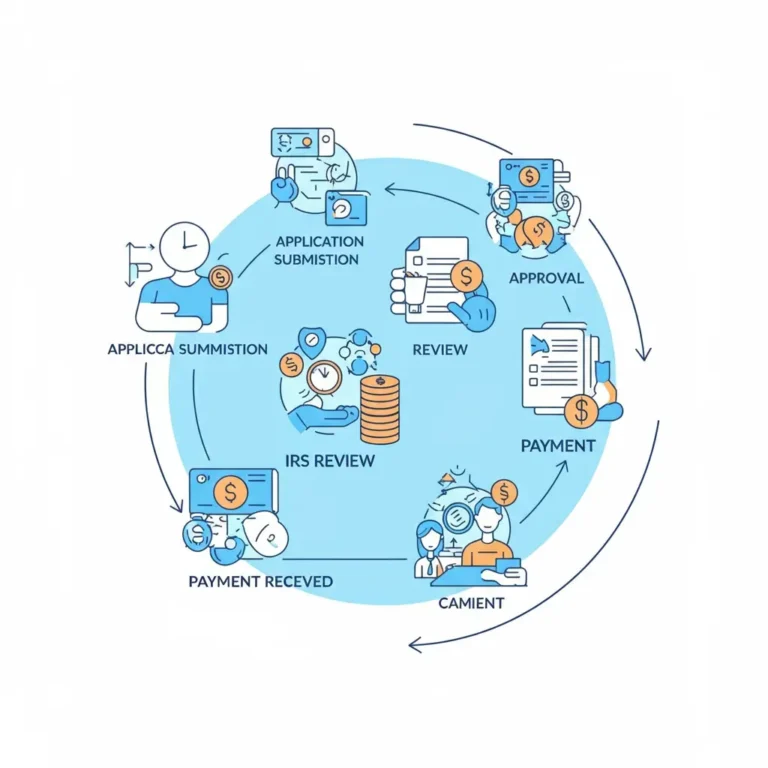

2. Steps to File Taxes for a Refund

To successfully receive a tax refund, follow these general steps:

- Gather Your Documents: Includes W-2s, 1099s, receipts, and other necessary paperwork.

- File Early: Submitting tax returns early helps prevent delays.

- Choose a Filing Method: You can e-file or submit physical paperwork.

- Select Your Payment Option: Choose either direct deposit or a mailed check.

3. Factors Affecting Refund Processing Times

Several factors impact how quickly you will get your refund, including:

- Accuracy of the tax return.

- Whether you file early, on time, or after the deadline.

- Choice of method (e-filing vs. paper filing).

- IRS processing workload during peak seasons.

4. Average Timeframes for Different Filing Methods

- E-Filing with Direct Deposit: Typically takes 1-3 weeks.

- Paper Filing with a Mailed Check: This may take 6-8 weeks or longer.

5. How the IRS Processes Refunds

Once the IRS receives your return, they verify your information, ensure all credits/deductions are correctly applied, and then calculate your refund. This process can take longer during high-volume or peak tax seasons, like late January and early April.

6. Paper Filing vs. E-Filing

E-filing is by far the fastest and most efficient way to file taxes. It reduces errors, speeds up processing, and allows for quicker refunds. Paper returns, on the other hand, often result in longer wait times due to manual handling.

7. Direct Deposit vs. Check Refunds

Direct deposit is the fastest option for receiving your refund. It eliminates many steps compared to waiting for a check by mail. When selecting direct deposit, double-check your bank account details to prevent errors.

8. Common Delays in Refund Processing

Some common reasons your refund might be delayed include:

- Errors on your tax return.

- Missing forms or information.

- Identity verification requirements.

- Filing during peak periods.

9. How to Track Your Tax Refund

The IRS provides tools to track your refund status, like the “Where’s My Refund?” portal and the IRS2Go mobile app. You’ll need to provide your Social Security Number, filing status, and refund amount to check your status.

10. Refund Timelines for Amended Returns

Amended returns (filed using Form 1040-X) generally take much longer than initial returns to process. It can take up to 20 weeks or more for refunds tied to amended returns.

11. Tips to Expedite Tax Refunds

- Double-check all numbers and forms before submission.

- Use e-filing and select direct deposit as your payment method.

- File as early as possible to beat peak processing times.

12. What to Do if Your Refund Is Late

If your refund is delayed beyond the average time, take these steps:

- Use the IRS tools to track its status.

- Check if any errors or additional verification are needed.

- Contact the IRS directly if processing exceeds six weeks for e-filing or eight weeks for paper filing.

13. Refund for Individuals vs. Businesses

While individual refunds generally follow the timelines highlighted earlier, business taxes might take longer to process due to their complexity. Ensure all documents for business taxes are accurate and file early to avoid delays.

14. Tax Refund Timelines for International Filers

If you’re filing from abroad, your refund timeline may be longer due to mailing delays and potential complications with international bank transfers. Ensure that your complete address and bank details are accurate.

15. Frequently Asked Questions

How long does it take to get a tax refund after filing electronically?

E-filing refunds are usually processed within 7-21 days, especially when selecting direct deposit.

Why is my refund taking longer than expected?

Errors in your tax return, identity verification complexities, or filing during peak periods can lead to delays.

Can I speed up my refund process?

Yes! File electronically, choose direct deposit, and double-check your form for errors.

What happens if I never receive my refund?

Contact the IRS to investigate. They may need to issue a payment trace or send a check if your direct deposit fails.

Are tax credits included in my refund?

Yes, refundable tax credits like the Earned Income Tax Credit or Child Tax Credit are included in the refund amount if you’re eligible.

When does the IRS process direct deposit refunds?

Direct deposit refunds are processed on business days. Refunds filed on weekends or holidays may face minor delays.

What should I do if I file an amended return?

Amended returns take approximately 20 weeks to process. Use the online refund tracker for updates.

By filing accurately, early, and electronically, you can minimize waiting times for your tax refund. Always select direct deposit for speed and security. Proceed with thorough preparation to optimize your tax filing experience this year!